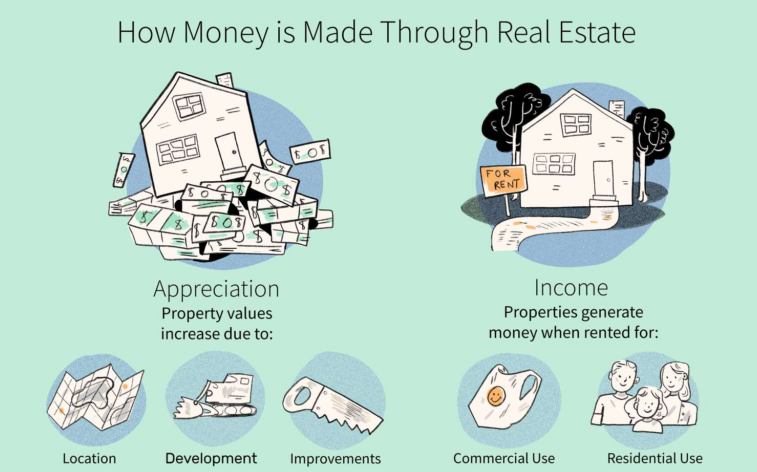

Real estate is a tangible asset that has the potential to generate wealth over time. It can be a great way to diversify your investment portfolio and build long-term wealth. However, real estate investing is not without its risks. It is important to do your research and understand the market before you Invest.

Here are five top ways to become rich by investing in real estate –

1. Buy and Hold Rental Properties

One of the most common ways to make money in real estate is to buy and hold rental properties. When you rent out a property, you generate monthly income from the rent. Over time, you can also build equity in the property as it appreciates in value.

To be successful in rental property investing, it is important to choose the right properties in good locations. You should also be prepared to manage the properties and deal with any maintenance issues that arise.

2. Flip Properties

Another way to make money in real estate is to flip properties. This involves buying undervalued properties, renovating them, and then selling them for a profit.

Flipping properties can be a lucrative way to make money, but it is also a lot of work. It is important to have a good understanding of the real estate market and the renovation process.

3. Invest in Real Estate Investment Trusts (REITs)

REITs are companies that own and operate income-producing real estate properties. When you invest in a REIT, you are essentially buying a share of the company’s portfolio of properties.

REITs offer a number of advantages over direct real estate investing. They are more liquid and easier to buy and sell than individual properties. They also provide a way to invest in a diversified portfolio of properties without having to manage them directly.

4. Invest in Real Estate Crowdfunding

Real estate crowdfunding platforms allow you to invest in real estate projects with other investors. This is a great way to get started in real estate investing with a relatively small amount of money.

When investing in real estate crowdfunding, it is important to carefully research the platform and the project you are investing in. You should also understand the risks involved in crowdfunding.

5. Invest in Real Estate Development

Real estate development involves building new properties or renovating existing properties. This can be a very lucrative way to make money in real estate, but it is also the riskiest.

Real estate development requires a significant amount of capital and expertise. It is important to have a thorough understanding of the development process and the real estate market.

Wrapping it Up

Real estate investing is a great way to build wealth over the long term. It provides you with a steady stream of income, equity growth, and tax advantages. However, it is important to understand the risks involved before you invest. Real estate is a tangible asset, which means it can be difficult to sell quickly if you need to raise cash. It is also important to factor in the costs of maintenance, property taxes, and insurance.

To be successful in real estate investing, it is important to do your research and choose an Investment strategy that is right for you. Consider your budget, risk tolerance, and investment goals. If you are new to real estate investing, it is a good idea to start with a less risky option, such as investing in a REIT or a real estate crowdfunding platform. As you gain more experience, you can consider more complex investment strategies, such as buying and holding rental properties or flipping properties.