The Real Estate (Regulation and Development) Act, 2016, often referred to as RERA, stands as a monumental reform in India’s real estate landscape. Its essence lies in transforming an industry characterized by opaqueness and uncertainty into one of transparency and accountability. RERA was introduced to address the long-standing concerns of homebuyers and investors and to instill a sense of confidence and reliability in the real estate market.

For investors, RERA goes beyond being a mere legal framework. It represents a fundamental shift in the way real estate transactions are conducted. Understanding RERA becomes paramount for investors looking to protect their interests, make informed decisions, and ensure their investments are secure.

In this guide, we embark on a journey to demystify RERA for investors. We will navigate through its core principles, delve into its pivotal provisions, and explore its direct impact on investment dynamics. By the end of this guide, you’ll have a solid grasp of RERA’s nuances, enabling you to navigate the real estate realm with confidence.

Join us as we unravel the layers of RERA, decipher its complexities, and shed light on how this groundbreaking legislation is shaping the future of real estate investments in India.

Understanding RERA Basics

Understanding the basics of RERA is crucial for investors as it sets the foundation for comprehending its implications on their investments.

Explanation of the Real Estate (Regulation and Development) Act

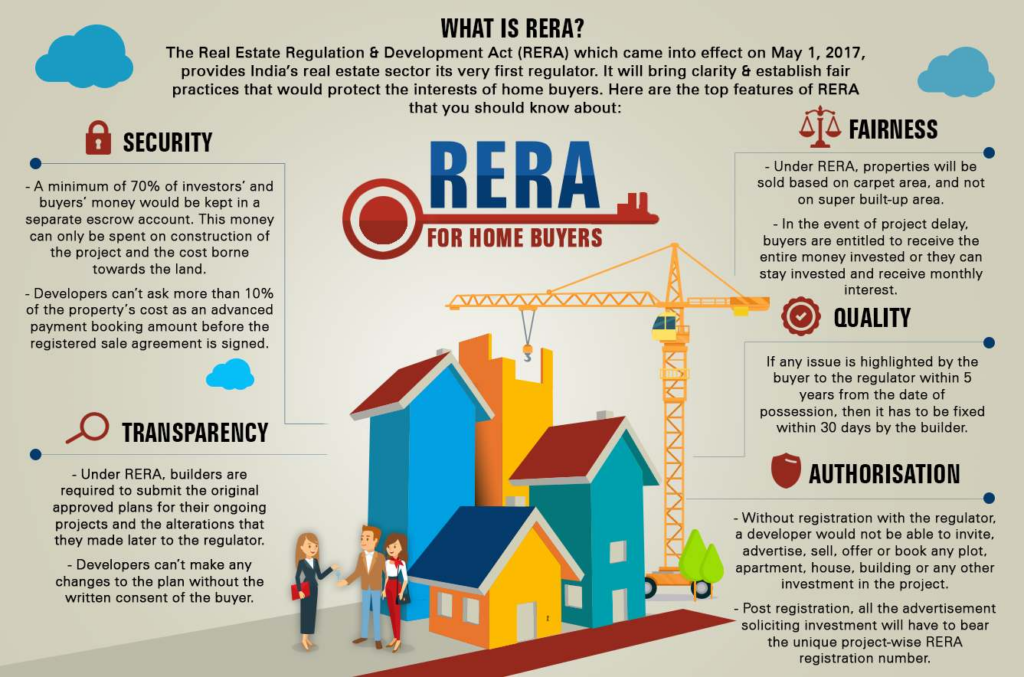

The Real Estate (Regulation and Development) Act, commonly known as RERA, is a landmark legislation enacted by the Government of India in 2016. It was formulated to bring transparency, accountability, and professionalism to the real estate sector, which had long been plagued by opaqueness and irregularities.

RERA aims to regulate the real estate industry by establishing a framework that safeguards the interests of homebuyers and investors. It achieves this by introducing a set of guidelines and regulations that developers, real estate agents, and buyers must adhere to throughout the lifecycle of a real estate project.

Key Objectives and Purpose of RERA

RERA’s objectives are multifaceted and far-reaching. Its primary goal is to protect the interests of homebuyers and investors who have often suffered due to project delays, unfulfilled promises, and lack of transparency. By holding developers accountable and ensuring the timely completion of projects, RERA aims to build trust and confidence in the real estate market.

RERA also seeks to promote fair competition among developers, enhance professionalism, and standardize practices within the industry. It envisions a real estate ecosystem where ethical practices prevail, and consumers can make well-informed decisions without fear of exploitation.

RERA’s Applicability to Different Real Estate Projects

RERA casts a wide net, encompassing various types of real estate projects. It applies to both residential and commercial projects, ensuring that investors and buyers across the spectrum are protected. Whether it’s a high-rise apartment complex or a sprawling commercial complex, RERA’s guidelines are designed to apply to all.

The act covers both new and ongoing projects. For new projects, developers are required to register with the respective state’s regulatory authority before marketing or selling. For ongoing projects that were launched before RERA’s enactment, developers must provide updated project information and adhere to the act’s provisions.

Key Provisions and Features of RERA

RERA’s provisions are designed to create a balanced and fair ecosystem for all stakeholders. Developers are held accountable for project delivery, buyers have legal protection against delays and misinformation, and agents operate within a regulated framework.

Mandatory Project Registration under RERA

One of RERA’s pivotal provisions is the mandatory registration of real estate projects with the respective state’s regulatory authority before advertising, marketing, or selling. This ensures that developers adhere to pre-defined norms, timelines, and quality standards. The registration process involves submitting detailed project information, including layout plans, approvals, and estimated completion time.

Promoter’s Responsibilities and Obligations

RERA places substantial responsibilities on developers or promoters. They are required to maintain a separate escrow account for each project, where 70% of the funds received from buyers must be deposited. This mechanism prevents the diversion of funds to other projects, ensuring timely project completion.

Promoters are also obligated to provide accurate project details on the RERA website, including project status, layout plans, approvals, and possession timelines. Any alterations to the project must be approved by at least two-thirds of the buyers.

Obligations of Real Estate Agents

Real estate agents also come under RERA’s purview. They must register with the regulatory authority to operate legally. This encourages transparency and accountability in property transactions. Agents are required to maintain records, facilitate property transactions, and only deal with RERA-registered projects.

Rights and Responsibilities of Buyers and Investors

RERA empowers buyers with several rights. They have the right to transparent information about the project, including layout plans, approvals, and possession timelines. If there’s a delay in possession, buyers are entitled to compensation. And they can also seek a refund and withdraw from the project if certain conditions are met.

Transparency and Accountability

RERA’s focus on transparency and accountability creates a conducive environment for investors to make well-informed decisions.

RERA’s Impact on Transparency in the Real Estate Sector

Transparency lies at the core of RERA’s mission. By requiring developers to register projects and furnish exhaustive project details, RERA guarantees that purchasers and investors can readily obtain precise and prompt information. This openness also encompasses project endorsements, layout blueprints, ownership specifics, and occupancy schedules.

With project particulars conveniently accessible on the RERA website, prospective buyers can judiciously determine their choices, relying on dependable data. Consequently, the likelihood of being ensnared by deceptive promotions or inadequate project particulars is mitigated.

Information Disclosure Requirements for Developers

RERA’s emphasis on information disclosure not only underscores its commitment but also compels developers to furnish exhaustive and precise project details. This encompassing approach entails divulging layout plans, approvals, development stages, and financial statements. Through such comprehensive disclosure, any semblance of ambiguity is eradicated, thereby ensuring a crystal-clear depiction of the project’s current status.

Also, developers are required to regularly update the project’s progress on the RERA website, ensuring that buyers and investors are informed about any changes or developments.

How RERA Ensures Accountability in Project Delivery

RERA’s provisions foster accountability at every stage of a real estate project. Firstly, developers are mandated to adhere diligently to the promised possession timelines; if they fall short, they must duly compensate buyers. Additionally, the stipulation to maintain a distinct escrow account for each project guarantees that funds are exclusively allocated to the designated endeavor, thereby thwarting any misappropriation.

Moreover, RERA also establishes a regulatory authority in each state to oversee project compliance. This authority has the power to address disputes, impose penalties, and ensure that developers adhere to RERA’s guidelines.

Consumer Protection Measures

RERA’s consumer protection measures empower buyers and investors with legal avenues to address grievances and seek remedies.

Introduction to the RERA Regulatory Authority

One of the cornerstones of RERA is the establishment of a regulatory authority in each state and union territory. This authority serves as the watchdog that ensures developers, buyers, and real estate agents adhere to the provisions of the act. Its primary objective is to protect the interests of consumers and maintain the integrity of the real estate market.

Role of Regulatory Authority in Resolving Disputes

The regulatory authority plays a crucial role in resolving disputes between buyers and developers. If a dispute arises regarding project delays, quality, or other concerns, buyers can approach the regulatory authority for resolution. The authority has the power to impose penalties on developers and ensure that grievances are addressed promptly.

This dispute-resolution mechanism provides buyers with a platform to seek justice without resorting to lengthy legal battles, thus enhancing consumer confidence.

Redressal Mechanisms for Buyers and Investors

RERA introduces several redressal mechanisms to safeguard the interests of buyers and investors. The act mandates the formation of an appellate tribunal to hear appeals against the orders of the regulatory authority. This ensures a fair and unbiased process for resolving disputes.

Additionally, RERA requires developers to provide a warranty on the quality of construction for a specified period. If any structural defects arise during this period, developers are required to rectify them at no additional cost to the buyer.

Project Delays and Compensation

RERA’s provisions on project delays and compensation strike a balance between developer and buyer interests. It ensures that developers are held accountable for meeting promised possession timelines, while buyers are safeguarded from undue delays and financial losses.

RERA’s Guidelines on Project Completion Timelines

Project delays have been a significant concern for buyers and investors in the real estate sector. RERA addresses this issue by stipulating clear project completion timelines. Developers are required to provide an estimated date of possession when registering the project, and they must adhere to this timeline.

RERA recognizes that unforeseen circumstances may cause delays. However, developers are mandated to provide reasons for the delay and must seek the consent of at least two-thirds of the buyers to extend the project completion timeline.

Consequences of Project Delays for Developers

RERA enforces strict consequences for developers who fail to deliver projects within the promised timeframe. If a developer delays possession, they are liable to pay compensation to the buyer. The compensation amount is typically a percentage of the amount paid by the buyer and varies based on the state’s regulations.

Furthermore, if a developer repeatedly fails to meet project timelines, RERA has the authority to revoke the project’s registration, effectively halting all sales and marketing activities.

Compensation Mechanisms for Buyers Affected by Delays

Buyers impacted by project delays hold the entitlement to compensation under RERA. Moreover, they possess the flexibility to either withdraw from the project and pursue a refund, coupled with the compensation amount. On the other hand, they also retain the option to persist with the project and subsequently demand compensation for the duration of the delay.

This compensation mechanism not only protects buyers from financial loss due to delays but also encourages developers to prioritize timely project completion.

Advanced Payment and Escrow Accounts

RERA’s provisions related to advance payments and escrow accounts promote financial prudence and accountability. Buyers can invest with greater confidence, knowing that their money is protected and being used for the project’s development.

RERA’s Provisions Related to Advance Payments

RERA introduces stringent regulations to protect buyers from financial risks associated with advance payments. Developers are not allowed to demand more than 10% of the property’s cost as an advance before signing a sale agreement. This provision prevents developers from collecting significant amounts upfront without providing adequate safeguards to buyers.

The intent behind this provision is to ensure that buyers’ money is not tied up in a project that might face delays or other uncertainties.

Importance of Maintaining Separate Escrow Accounts

One of RERA’s notable contributions to investor protection is manifested in the demand for developers to uphold separate escrow accounts for each project. Specifically, developers are obligated to place 70% of the funds received from buyers into this designated account. Consequently, these funds are strictly allocated for the precise construction and advancement of the designated project.

By enforcing this provision, RERA effectively guarantees that funds amassed from buyers remain unswervingly devoted to the intended project’s construction, thereby diminishing the potential for financial mismanagement.

How Escrow Accounts Protect Investor Interests

The initiation of escrow accounts effectively tackles a persistent worry among buyers – the potential mishandling of their funds. By partitioning funds and designating them solely for a specific project, buyers gain heightened confidence that their capital will be employed as originally intended.

Moreover, this practice not only establishes transparency but also bolsters accountability. Consequently, investors can rest assured that their funds are exclusively channeled into the progression of the property they have committed to, bolstering their sense of security and confidence.

Legal Compliance and Title of Property

RERA’s focus on legal compliance and clear land titles enhances investor confidence by mitigating the risks associated with unclear ownership and legal disputes.

Verification of Legal Title and Ownership of Land

RERA places significant emphasis on the legal compliance of real estate projects. Developers are required to provide valid documents proving their ownership of the land on which the project is being developed. This verification of legal title ensures that buyers are investing in properties with clear and undisputed ownership.

This provision safeguards buyers from potential legal disputes arising from unclear land titles.

RERA’s Focus on Clear Land Titles

RERA’s insistence on clear land titles is a critical step in minimizing risks for buyers. Developers must verify the legality of the land title before commencing the project. This process helps prevent instances where buyers could lose their investment due to legal complications surrounding the land’s ownership.

Clear land titles provide a foundation of trust and security for investors, reducing the chances of unforeseen legal challenges.

Implications of Investing in Projects with Unclear Titles

Moreover, Investing in a project with unclear land titles can lead to serious consequences, including legal battles and financial loss. RERA’s requirement for developers to provide valid land title documents ensures that buyers have the necessary legal protection.

Projects with clear titles not only provide peace of mind to buyers but also facilitate the process of securing loans from financial institutions.

Registration and Advertisements

Understanding the importance of RERA registration and the implications of investing in unregistered projects empowers investors to make well-informed decisions.

RERA’s Regulations on Project Advertisements

RERA addresses the issue of misleading advertisements in the real estate sector. Developers are required to register their projects with the regulatory authority before advertising or selling any units. This means that developers cannot promote or market a project until it has received the necessary approvals and is registered under RERA.

This provision ensures that buyers receive accurate and reliable information about the project before making any investment decisions.

Importance of Verifying RERA Registration Before Investing

For buyers and investors, one of the key takeaways is the necessity of verifying whether a project is registered under RERA before considering an investment. RERA registration provides a level of assurance that the project has received the necessary approvals and is compliant with the law.

Verifying RERA registration before investing helps buyers avoid unscrupulous developers and projects that lack the necessary legal clearances.

Consequences of Investing in Unregistered Projects

RERA’s stance on this matter is unequivocal, as it enforces strict penalties on developers who engage in the promotion or sale of unregistered projects. Consequently, if buyers choose to invest in an unregistered project, the specter of loss looms large, given the absence of assured legality and compliance.

However, RERA’s unwavering emphasis on registration doesn’t just stop at penalties. It serves as a comprehensive shield, defending buyers against potential fraudulent activities. Furthermore, this resolute focus on registration operates as a robust filter, guaranteeing that investors channel their resources exclusively into projects that have meticulously fulfilled the essential prerequisites of legality and regulation.

Investor Checklist: Due Diligence

RERA empowers investors with the tools to conduct thorough due diligence before making any investment decisions. Following a comprehensive checklist can help investors mitigate risks and make informed choices.

Verifying Project Approvals and Permissions

Keeping in mind before investing, investors should ensure that the project has received all necessary approvals from the relevant authorities. This includes approvals for building plans, environmental clearances, and other regulatory permissions. Verifying these approvals confirms the project’s legitimacy and compliance.

Assessing Developer’s Track Record and Financial Stability

Moreover, Investigating the developer’s track record is crucial. Investors should research the developer’s past projects, delivery record, and reputation in the market. Additionally, assessing the developer’s financial stability helps determine their capacity to complete the project successfully.

Evaluating RERA Registration and Compliance

Investors should verify whether the project is registered under RERA and whether the developer is compliant with RERA’s guidelines. This includes checking the project’s timeline for completion, progress updates, and adherence to financial practices.

Understanding the Sale Agreement and Terms

Reviewing the sale agreement is essential. Investors should understand the terms, payment schedule, and possession timeline outlined in the agreement. Any discrepancies or ambiguous clauses should be clarified before proceeding.

Inspecting the Property Site

Visiting the property site in person allows investors to assess its location, proximity to amenities, and overall development progress. This firsthand inspection can reveal any deviations from the promised features.

Verifying Infrastructure and Surrounding Developments

The surrounding infrastructure plays a crucial role in the property’s value appreciation. Investors should research ongoing and planned developments in the vicinity, as well as factors like connectivity, access to transportation, and commercial establishments.

Engaging Legal and Financial Advisors

Seeking guidance from legal and financial experts is advisable. These professionals can provide insights into the legal aspects of the project, verify documentation, and ensure compliance with RERA regulations.

Challenges and Future Outlook

RERA’s challenges are not insurmountable, and its future outlook is promising. As the real estate industry adapts to the new regulatory framework, investors can expect increased transparency, reduced risks, and a more investor-friendly environment.

Challenges Faced in RERA Implementation

While RERA has made significant strides in regulating the real estate sector, certain challenges persist. One challenge is the varying interpretation and implementation of RERA’s provisions across different states. This inconsistency can lead to confusion and hinder the uniform enforcement of the law.

Additionally, the time and resources required for RERA compliance can be burdensome for smaller developers, potentially affecting their ability to enter the market.

RERA’s Role in Shaping the Future of Indian Real Estate

Despite challenges, RERA has fundamentally transformed the Indian real estate landscape. Its emphasis on transparency, accountability, and consumer protection has elevated buyer confidence and investor trust. Developers are now compelled to prioritize timely project delivery and adhere to ethical business practices.

The increased focus on project completion timelines and stringent regulations have also reduced the prevalence of project delays.

Government’s Continuous Efforts to Strengthen RERA

Besides, the government remains committed to refining and enhancing RERA’s effectiveness. Amendments to the act and its rules are regularly considered to address emerging challenges and ensure that RERA remains relevant in the evolving real estate environment.

Additionally, the government’s efforts to digitalize property registrations and processes contribute to streamlining the real estate ecosystem and making it more accessible to buyers and investors.

Conclusion

Overall, As an investor, understanding RERA’s provisions and implications is essential for making informed investment decisions. RERA equips you with tools to assess project credibility, legal compliance, and financial stability, thereby minimizing risks and uncertainties.

RERA not only safeguards your interests but also contributes to the overall growth and credibility of the real estate sector. By promoting ethical practices and project accountability, RERA ensures that you, as an investor, are part of a transparent and trustworthy ecosystem.

We encourage you to incorporate the principles and guidelines outlined in this guide into your investment strategy. By doing so, you can navigate the real estate market with confidence, secure in the knowledge that your investments align with your financial goals and are protected by RERA’s framework.

In a sector known for its complexity and potential pitfalls, RERA offers a beacon of hope. It empowers you to invest with clarity and certainty, forging a path toward a more transparent and secure real estate landscape.

RERA’s impact is far-reaching and enduring. By embracing its provisions and principles, you are contributing to the ongoing transformation of India’s real estate sector, ensuring that your investments are not just financially sound but ethically aligned with the highest standards of the industry.