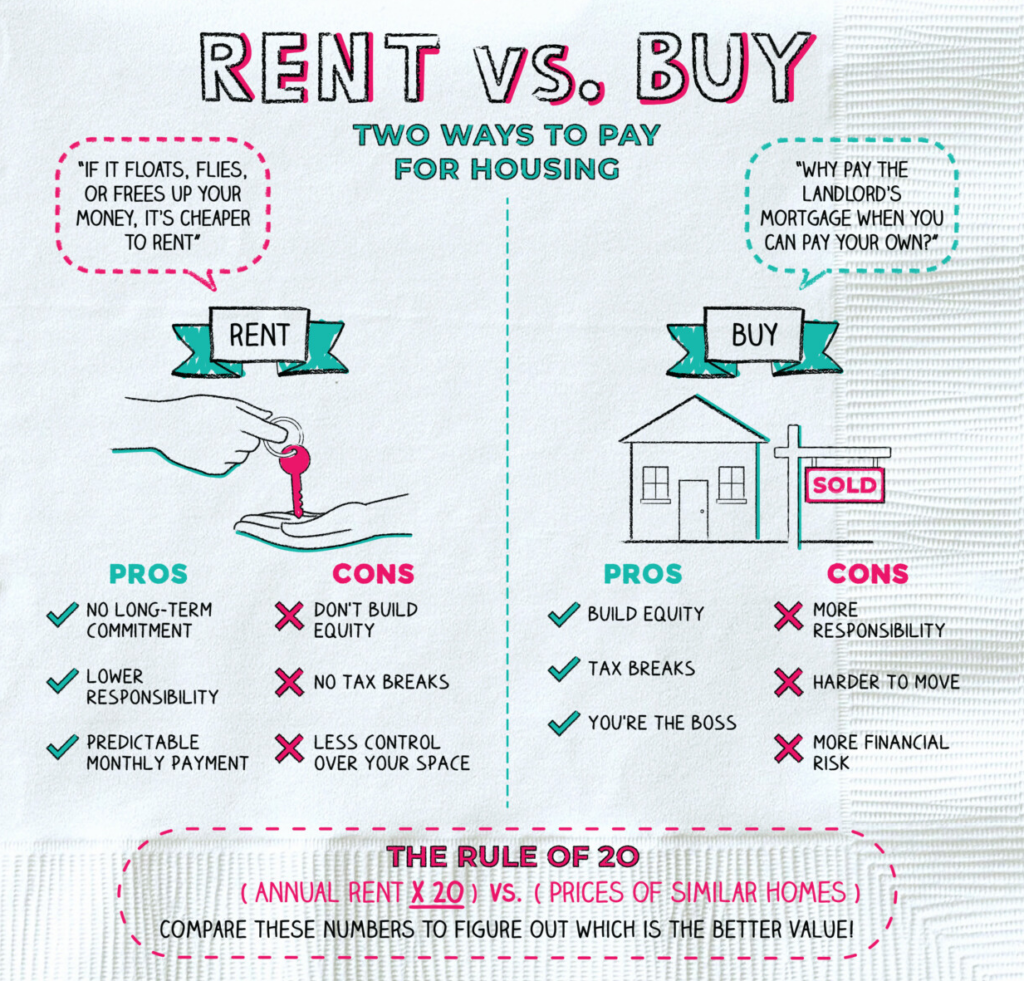

When it comes to the age-old debate of renting versus buying a house, it’s essential to carefully consider the pros and cons associated with each option. Renting and buying a house has distinct advantages and disadvantages that can significantly impact an individual’s financial situation and overall lifestyle. In this article, we will delve into the various aspects of renting and buying, exploring the benefits and drawbacks of each choice. By understanding these factors, readers can make an informed decision based on their unique circumstances and goals.

Before delving into the pros and cons, it’s important to understand the fundamental differences between renting and buying a house. Renting involves leasing a property from a landlord or property management company. As a renter, you pay a predetermined amount of money, typically every month, to occupy the premises. On the other hand, buying a house refers to the process of Purchasing a Property and becoming a homeowner. This typically involves securing a mortgage loan to finance the purchase, followed by regular mortgage payments over a specified term.

Considering the pros and cons of renting and buying a house is crucial as it directly affects an individual’s financial stability and long-term goals. Without a thorough analysis of the advantages and disadvantages, one may make an uninformed decision that could lead to unexpected challenges or missed opportunities. By taking the time to assess the various factors, individuals can align their housing choices with their lifestyle preferences and financial aspirations.

Pros of Renting a House

Renting a house offers several advantages that make it an attractive option for many individuals. Let’s delve further into the pros of renting:

Flexibility and Mobility

Ability to Easily Relocate: One of the significant advantages of renting is the ability to easily relocate. Whether it’s for career opportunities, personal reasons, or a desire for a change of scenery, renters have the freedom to move residences without the burden of selling a property. This flexibility is particularly beneficial for individuals who anticipate frequent relocations or are unsure about their long-term living arrangements.

No Long-Term Commitment: Renting a house allows individuals to avoid long-term commitments. Lease agreements typically span a few months to a year, providing the freedom to explore different living arrangements or neighborhoods without being tied down to a specific property. This lack of long-term commitment can be advantageous for those who prefer flexibility in their housing options or have uncertain plans.

Lower Upfront Costs

No Down Payment Required: One of the most significant financial barriers to homeownership is the down payment. However, when renting a house, there is no requirement for a substantial down payment. Renters can secure a property with a security deposit and the first month’s rent, making it a more affordable option for those with limited savings or who prefer to allocate their funds elsewhere.

Lower Initial Expenses (e.g., Security Deposit): Renting a house entails lower initial expenses compared to buying a house. While landlords may request a security deposit, it is generally significantly lower than the down payment required when purchasing a home. This makes renting a more accessible choice for individuals who may not have the financial resources to cover the upfront costs associated with homeownership.

Minimal Responsibility for Maintenance and Repairs

Landlord is Typically Responsible for Repairs: As a renter, you can enjoy the convenience of having the landlord or property management company bear the responsibility for major repairs and maintenance. When a significant issue arises, such as a plumbing problem or a faulty electrical system, the landlord typically must address and rectify the situation. This alleviates renters from the financial burden and time-consuming tasks associated with property upkeep.

Avoidance of Unexpected Expenses: Renting a house provides peace of mind when it comes to unexpected expenses. Major repairs or maintenance issues are typically the responsibility of the landlord. As a result, renters can avoid the financial strain of unforeseen repairs, ensuring more predictable monthly expenses. This stability in expenses allows individuals to better manage their budget and plan for other financial goals.

Cons of Renting a House

While renting a house offers certain advantages, it also comes with its share of drawbacks. Let’s explore further the cons of renting:

Lack of Long-Term Investment

No Equity Buildup: One significant disadvantage of renting a house is the lack of equity buildup. Unlike homeowners who gradually build ownership through mortgage payments, renters do not have the opportunity to accumulate equity in the property. Rent payments solely contribute to the cost of occupancy, rather than building long-term wealth.

Rent Payments do not Contribute to Ownership: Renters do not gain any ownership stake or potential return on Investment through their monthly rent payments. Unlike homeowners who can potentially build wealth by paying down their mortgage and benefiting from property appreciation, renters do not have the opportunity to participate in the financial benefits of property ownership.

Limited Control over the Property

Restrictions on Modifications and Customization: Renters often face limitations when it comes to modifying or customizing their living space. Landlords may impose restrictions on painting walls, making structural changes, or other alterations that would allow personalization of the property. This lack of control over the physical aspects of the house can be frustrating for individuals who desire to make it their own.

Subject to Potential Rent Increases: Renters are susceptible to rent increases during the lease term. Landlords have the authority to adjust rental rates based on market conditions or other factors. These increases can impact the affordability of the rental property and may require renters to reassess their budget or consider alternative housing options.

Absence of Tax Benefits

No deductions for mortgage interest or property taxes: Renters do not have access to the tax benefits associated with homeownership. Homeowners can typically deduct mortgage interest and property taxes, which can significantly reduce their taxable income. Renters, however, do not have the opportunity to take advantage of these deductions, which could potentially lead to higher overall tax liabilities.

Pros of Buying a House

Buying a house offers several advantages that make it an appealing option for many individuals. Let’s delve further into the pros of buying:

Potential for Long-Term Investment and Equity

Building Wealth Through Property Appreciation: One of the significant advantages of buying a house is the potential for long-term wealth accumulation through property appreciation. Over time, the value of a well-maintained property may increase, allowing homeowners to build equity and potentially realize a return on their investment. Property appreciation can serve as a valuable asset in building personal wealth.

Opportunity for Home Value Appreciation: Homeownership provides individuals with the opportunity to benefit from home value appreciation. As the real estate market fluctuates and demand increases, well-located and well-maintained properties may experience an appreciation in their value. This appreciation can offer significant financial gains to homeowners, further enhancing the overall value of their investment.

Sense of Ownership and Stability

Freedom to Personalize and Modify the Property: Buying a house grants homeowners the freedom to personalize their living space according to their preferences. Whether it’s painting the walls, renovating the kitchen, or making structural changes, homeowners have the autonomy to modify and customize their property to suit their tastes and lifestyle. This level of control allows for a greater sense of ownership and satisfaction with the living environment.

Stability in Terms of Location and Living Arrangements: Homeownership provides stability in terms of location and living arrangements. Homeowners have the assurance of a permanent place to call home, free from concerns about lease renewals, rent increases, or the potential need to move due to landlord decisions. This stability can contribute to a sense of security and emotional well-being.

Tax Benefits and Potential Deductions

Deductions for Mortgage Interest and Property Taxes: Homeowners can take advantage of various tax benefits not available to renters. One significant benefit is the ability to deduct mortgage interest and property taxes from their taxable income. These deductions can lead to substantial tax savings and reduce overall tax liabilities, resulting in increased disposable income.

Potential for Capital Gains Tax Exemptions: Homeowners may be eligible for capital gains tax exemptions when selling their primary residence. In many countries, homeowners can exclude a certain amount of capital gains from taxation if they meet specific criteria, such as residing in the property for a minimum period. This potential exemption can provide significant tax savings and further enhance the financial benefits of owning a house.

Cons of Buying a House

While buying a house offers numerous benefits, it also comes with certain drawbacks. Let’s explore further the cons of buying:

High Upfront Costs

Down Payment Requirement: One of the significant barriers to homeownership is the high upfront cost in the form of a down payment. Lenders typically require a percentage of the home’s purchase price as a down payment, which can be a substantial amount of money. Saving for a down payment can take time and may pose challenges for individuals with limited savings or those struggling to meet the required amount.

Closing Costs and Associated Fees: In addition to the down payment, buyers must also account for closing costs and associated fees. These expenses include loan origination fees, appraisal fees, title insurance, and other costs associated with the transfer of ownership. These additional expenses can further strain the buyer’s financial resources.

Long-Term Financial Commitment

Monthly Mortgage Payments: Homeownership comes with the responsibility of monthly mortgage payments. These payments encompass the principal amount borrowed, interest, property taxes, and, in some cases, private mortgage insurance (PMI). Buyers must ensure they have the financial stability and resources to comfortably manage these ongoing payments over the long term.

Responsibility for Maintenance and Repairs: Unlike renters, homeowners are solely responsible for maintenance and repairs. This includes routine tasks like landscaping, as well as unexpected repairs such as a broken furnace or a leaky roof. The financial and time commitment associated with property upkeep can be substantial and may require homeowners to allocate resources for maintenance and repairs.

Potential for Property Value Depreciation

Market Fluctuations and Economic Factors: Home values are subject to market fluctuations and economic factors beyond the homeowner’s control. While property appreciation is possible, there is also a risk of property value depreciation due to changing market conditions. Homeowners may experience a decline in their property’s value, which can impact their overall financial situation and potential return on investment.

Costs Associated with Selling the Property: Selling a house involves various costs that homeowners need to consider. These costs may include real estate agent commissions, closing costs, and potential capital gains taxes. These expenses can impact the overall return on investment and should be factored in when assessing the long-term financial implications of homeownership.

Factors to Consider in the Renting vs Buying Decisions

When deciding between renting and buying a house, it’s important to carefully evaluate various factors that can influence the choice. Consider the following key factors:

Financial Considerations

Affordability and Budgeting: Assess your financial situation and determine what you can comfortably afford. Consider not just the monthly mortgage payment but also additional costs such as property taxes, insurance, maintenance, and potential homeowner association fees. Compare these expenses with the cost of renting a comparable property. Analyze your budget to ensure you can manage the financial obligations associated with homeownership without straining your finances.

Current and Future Income Stability: Evaluate your current employment situation and consider the stability of your income. Job security and the potential for relocation should be taken into account. If your income is unstable or you anticipate a significant change shortly, renting may provide more flexibility and minimize financial risks.

Personal Circumstances and Lifestyle

Future Plans and Potential Mobility: Consider your plans and the potential for mobility. If you anticipate job changes or are unsure about your long-term living arrangements, renting might be a more suitable option as it offers greater flexibility to relocate without the complexities of selling a property.

Desired Level of Control and Customization: Assess your preferences regarding control and customization of the living space. Renting often comes with restrictions on modifications and personalization, while homeownership provides the freedom to modify and personalize the property to suit your preferences. Determine how important it is for you to have the ability to make changes and truly make the space your own.

Local Housing Market Conditions

Rental Availability and Pricing Trends: Research the rental market in your desired area. Determine the availability of rental properties and assess the pricing trends. If rental options are limited or rental prices are increasing significantly, it may be more advantageous to consider buying a house, as it can provide stability in terms of housing costs.

Real Estate Market Stability and Property Values: Evaluate the stability of the real estate market in the area you are interested in. Consider the historical trends of property values and the potential for future appreciation. If the market is stable and property values have shown consistent growth, buying a house may present an opportunity for long-term financial benefits.

Conclusion

Deciding between renting and buying a house is a significant financial and lifestyle choice that requires careful consideration of the pros and cons associated with each option. By weighing the advantages and disadvantages, individuals can make an informed decision that aligns with their goals and circumstances.

Renting a house offers flexibility, mobility, and lower upfront costs. Renters have the freedom to easily relocate, avoid long-term commitments, and benefit from minimal responsibility for maintenance and repairs. However, renting lacks long-term investment potential, limited control over the property, and the absence of tax benefits.

On the other hand, buying a house provides the potential for long-term Investment, a sense of ownership and stability, and tax benefits. Homeowners can build wealth through property appreciation, personalize their living space, and take advantage of deductions for mortgage interest and property taxes. However, buying a house requires high upfront costs, entails a long-term financial commitment, and carries the potential for property value depreciation.

Remember, this decision has long-term implications for your financial well-being and lifestyle. By considering the factors discussed and reflecting on your personal needs and goals, you can make an informed decision that sets you on the path toward a comfortable and fulfilling living arrangement.

Click here